POLAND

Plastpol 2024 sees uptick in international attendance / Green transition, energy efficiency, competitiveness dominate discussions

By Vladislav Vorotnikov

Poland’s international fair for plastics and rubber processing, Plastpol, has according to organiser Targi Kielce (Kielce; www.targikielce.pl/en) strengthened its status as one of the key events in the European plastics industry in 2024, setting the stage for several deals and giving the floor to important discussions.

Poland’s international fair for plastics and rubber processing, Plastpol, has according to organiser Targi Kielce (Kielce; www.targikielce.pl/en) strengthened its status as one of the key events in the European plastics industry in 2024, setting the stage for several deals and giving the floor to important discussions.

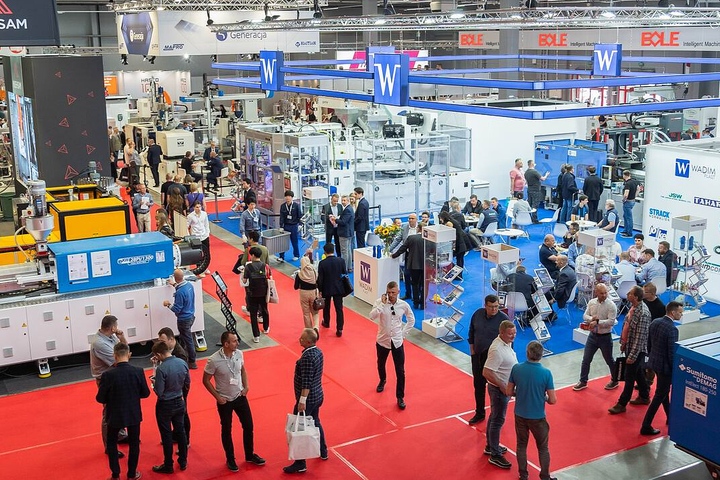

Walking (or standing) and talking: the trade fair saw several deals sealed and products sold (Photo: Targi Kielce) |

The show, held from 21-24 May, played host to 603 companies from 31 countries, mainly from Europe, Asia, and the Middle East. The number of participants remained almost the same as in the previous year when the show was attended by 600 firms, while international representation has become more diverse – in 2023, the fair attracted visitors from 26 countries.

The prevailing mood among the participants at Plastpol 2024 was one of optimism, the organiser said, and investment dynamics largely back the idea that Polish plastics companies feel more confident about the industry outlook.

Related: Mood in Polish plastics processing industry improves beyond expectations

As estimated by Plastics Europe Polska (Warsaw; www.plasticseurope.org), the rubber and plastic products production sector saw a surge in investments in 2023, reaching PLN 7.4 bn (EUR 1.7 bn), compared with PLN 6.1 bn (EUR 1.4 bn) in the previous year. This upward dynamic was far better than in the chemical industry in general.

Business deals and machinery sales

The plastics industry’s solid investment potential translated into a large number of agreements signed during the fair. “More than 50% of the business meetings held here in Kielce resulted in contracts,” Vincent Kundrat, executive director of Meyer Europe (Košice, Slovakia; www.meyer-corp.eu), said.

For example, ML Polyolefins (Gronowo Górne, Poland; www.mlpolyolefins.com/en), a Central and Eastern Europe polypropylene regranulate producer, signed a cooperation agreement with Keeeper Group (Hille, Germany; www.keeeper.com/en).

During the trade fair, high-tech injection moulding machines were sold by machinery manufacturers ranked among the world leaders, including Arburg (Loßburg, Germany; www.arburg.com/en), Engel (Schwertberg, Austria; www.engelglobal.com), and Bole Europe Technology (Mysłowice, Poland; www.bole-europe.com). The contractors also include Polish entrepreneurs.

Italy’s Toyo Europe (Azzano Mella; www.toyo-europe.com) signed contracts for robots and injection moulding machinery, and China’s Borche (Guangzhou, Guangdong, China; www.borcheglobal.com) agreed on machinery sales to Poland’s Plastigo (Częstochowa; www.plastigo.pl).

“Energy efficiency was the key to many negotiations,” Andrzej Mochoń, president of the management board of Targi Kielce, stated.

For example, ML Polyolefins (Gronowo Górne, Poland; www.mlpolyolefins.com/en), a Central and Eastern Europe polypropylene regranulate producer, signed a cooperation agreement with Keeeper Group (Hille, Germany; www.keeeper.com/en).

During the trade fair, high-tech injection moulding machines were sold by machinery manufacturers ranked among the world leaders, including Arburg (Loßburg, Germany; www.arburg.com/en), Engel (Schwertberg, Austria; www.engelglobal.com), and Bole Europe Technology (Mysłowice, Poland; www.bole-europe.com). The contractors also include Polish entrepreneurs.

Italy’s Toyo Europe (Azzano Mella; www.toyo-europe.com) signed contracts for robots and injection moulding machinery, and China’s Borche (Guangzhou, Guangdong, China; www.borcheglobal.com) agreed on machinery sales to Poland’s Plastigo (Częstochowa; www.plastigo.pl).

“Energy efficiency was the key to many negotiations,” Andrzej Mochoń, president of the management board of Targi Kielce, stated.

Circularity continues to rise

As in previous years, the fair kicked off with a conference hosted by Plastics Europe Polska, during which Anna Kozera-Szałkowska, managing director at Plastics Europe Polska, offered a comprehensive report on the European plastics industry’s present situation. This conference set the tone for the event, providing a platform for industry leaders to share insights and discuss strategies for the future.

One of the key takeaways was that the European plastics industry has become increasingly circular. In 2022, the production of circular plastics in Europe reached 11.7 mn t, representing 19.7% of total output, Kozera-Szałkowska noted. For Poland, this share stood at 30.7%.

Across Europe in 2022, 10.4 mn t of circular plastics were used to produce plastic products and parts. This represents 19.2% of all processed plastics in Europe. In Poland, this figure amounted to 16.4%.

One of the key takeaways was that the European plastics industry has become increasingly circular. In 2022, the production of circular plastics in Europe reached 11.7 mn t, representing 19.7% of total output, Kozera-Szałkowska noted. For Poland, this share stood at 30.7%.

Across Europe in 2022, 10.4 mn t of circular plastics were used to produce plastic products and parts. This represents 19.2% of all processed plastics in Europe. In Poland, this figure amounted to 16.4%.

Concerns that Europe is losing competitive edge

As indicated in the report, while progress in the area of green transition is moving apace, the European plastics industry’s position in the global arena appears less promising. The sector is facing increasing competition from other regions, particularly Asia, which is impacting its global market share. This trend underscores the urgent need for the European plastics industry to enhance its competitiveness and innovation.

Related: Sluggish investments, rising costs threaten competitiveness of European auto sector

The weakening of the global economy has led to a reduction in demand for plastic products, Kozera-Szałkowska said. In 2022, global plastics production reached 400.3 mn t, but Europe’s share is steadily shrinking. In 2022, Europe accounted for only 14% of global plastics production, against 22% in 2006.

As a result of its declining global market share, Europe is becoming increasingly dependent on imports, particularly from regions with lower environmental and sustainability standards. This trend not only weakens Europe’s ability to invest in plastics circularity, but also hampers the transformation of sectors that rely on the material. This is a worrying trend.

Related: Proposed sustainable carbon policy package aims to boost European competitiveness

“If the decline in competitiveness continues, Europe will become increasingly dependent on imports which do not necessarily meet EU sustainability standards, and the ability of European plastics producers to invest in circularity, along with the transitions of the many sectors that rely on plastics, will be undermined,” Kozera-Szałkowska said in a follow-up comment to Plasteurope.com.

“It is essential that the competitiveness of the European plastics sector is restored. To achieve this, a level playing field needs to be urgently created. It can be done through, for example, the development of a comprehensive EU equivalent to the US Inflation Reduction Act and the creation of a harmonised and consistent regulatory framework across the EU Single Market,” Kozera-Szałkowska suggested.

Related: Sluggish investments, rising costs threaten competitiveness of European auto sector

The weakening of the global economy has led to a reduction in demand for plastic products, Kozera-Szałkowska said. In 2022, global plastics production reached 400.3 mn t, but Europe’s share is steadily shrinking. In 2022, Europe accounted for only 14% of global plastics production, against 22% in 2006.

As a result of its declining global market share, Europe is becoming increasingly dependent on imports, particularly from regions with lower environmental and sustainability standards. This trend not only weakens Europe’s ability to invest in plastics circularity, but also hampers the transformation of sectors that rely on the material. This is a worrying trend.

Related: Proposed sustainable carbon policy package aims to boost European competitiveness

“If the decline in competitiveness continues, Europe will become increasingly dependent on imports which do not necessarily meet EU sustainability standards, and the ability of European plastics producers to invest in circularity, along with the transitions of the many sectors that rely on plastics, will be undermined,” Kozera-Szałkowska said in a follow-up comment to Plasteurope.com.

“It is essential that the competitiveness of the European plastics sector is restored. To achieve this, a level playing field needs to be urgently created. It can be done through, for example, the development of a comprehensive EU equivalent to the US Inflation Reduction Act and the creation of a harmonised and consistent regulatory framework across the EU Single Market,” Kozera-Szałkowska suggested.

14.06.2024 Plasteurope.com [255543-0]

Published on 14.06.2024

German version of this article...

German version of this article...