GREIF

Acquisition of Ipackchem enters final stretch / Little change to full-year forecast

US industrial packaging manufacturer Greif (Delaware, Ohio; www.greif.com) is said to be close to completing its takeover of French competitor Ipackchem (Paris; www.ipackchem.com). The current owner, SK Capital Partners (New York, New York; www.skcapitalpartners.com), is thus parting with the stake after less than three years for USD 538 mn (EUR 507 mn). Greif CEO Ole Rosgaard said the transaction is to be completed in the second quarter of 2024.

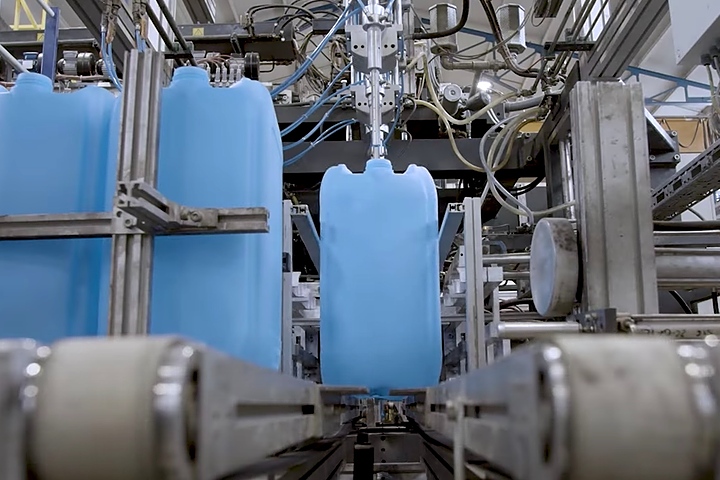

Blow moulding of plastic canisters at Greif in the US (Photo: Greif) |

While the much larger Greif has a portfolio of drums made of steel, plastics, and paper, along with IBCs, canisters, and corrugated board, pipes, and roll cores in the paper sector, Ipackchem offers smaller containers such as bottles. The proprietary advanced in-mould fluorination technology, to which Greif now has access, is seen as one reason for the deal. Just a few weeks ago, Greif also acquired the small container manufacturer Reliance Products (Winnipeg, Canada).

Ipackchem operates 13 plants worldwide with 1,400 employees. Since acquiring a majority stake in US firm TPG Plastics (Murray, Kentucky; www.tpgplastics.com), the French company has also been active in North America. In the 12 months to September, turnover was reported at EUR 220 mn, and adjusted EBITDA around EUR 54 mn.

Greif’s two business units, industrial packaging, and paper, packaging, and services, reportedly generated revenue of USD 1.33 bn in the third quarter, down 18% from the same period of last year. EBITDA, adjusted only for minor one-off effects for restructuring, costs for acquisitions, and depreciation, was said to have fallen 10% to USD 226.5 mn. In particular, the results of the two group divisions developed very differently, with similar declines in sales – down 20% and 16%, respectively. The adjusted EBITDA of industrial packaging operations is said to have dropped 8%, while the results on the other side slumped a good 25%.

Related: Greif’s IBC production plant opens in Turkey

Industrial packaging reportedly suffered most in its home markets of North America and Latin America, where sales volumes each fell by almost 20%. The EMEA region held up comparatively well with a decline of 7%. Prices also fell by between 6% and 10% in all regions and segments.

For the full year, Greif said it was maintaining its previous forecast, but it narrowed the range to USD 790 mn-USD 820 mn from the previous USD 780 mn-USD 830 mn.

02.11.2023 Plasteurope.com [253946-0]

Published on 02.11.2023

German version of this article...

German version of this article...