EMS

Polyamide specialist reports record sales / Profits fall / CEO Martullo-Blocher cites strong growth potential in China

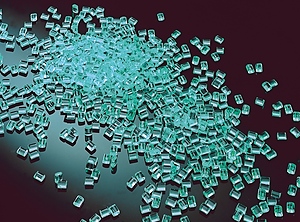

Polyamide granulates (Photo: Ems) |

While many plastics manufacturers were hit hard last year by the energy crisis, other effects of the war in Ukraine, and China’s strict zero-Covid policies, the focus on specialities and new business saved Ems Group (Domat, Switzerland; www.ems-group.com) from further damage.

The polyamide specialist reported a 4.6% drop in 2022 EBIT to CHF 611 mn (EUR 619 mn), with net profit slumping 3.3% to CHF 535 mn. Sales, on the other hand, climbed 8.3% on higher sales prices to a new record of CHF 2.44 bn despite negative currency effects.

The main business segment of High Performance Polymers benefited disproportionately from the increased focus on specialities to perform slightly better than the secondary segment for Speciality Chemicals, which felt more of the impact of the negative economic environment. Last year, sales in the high performance area increased 8.8% to CHF 2.19 bn, and the EBIT decline of 4.2% to CHF 548 mn was somewhat weaker than in the group as a whole. Specialty Chemicals recorded a decline in EBIT of 7.9% to CHF 63 mn, with sales up 4.3% to CHF 254 mn.

Ems said it expects the economy to remain subdued in 2023. Nevertheless, the company anticipates sales and EBIT for 2023 to be slightly above levels from the previous year. Management has forecast positive impetus from investments to increase capacity and energy efficiency at the headquarters in Domat and other locations, especially in China (PIE 08.06.2022).

The polyamide specialist reported a 4.6% drop in 2022 EBIT to CHF 611 mn (EUR 619 mn), with net profit slumping 3.3% to CHF 535 mn. Sales, on the other hand, climbed 8.3% on higher sales prices to a new record of CHF 2.44 bn despite negative currency effects.

The main business segment of High Performance Polymers benefited disproportionately from the increased focus on specialities to perform slightly better than the secondary segment for Speciality Chemicals, which felt more of the impact of the negative economic environment. Last year, sales in the high performance area increased 8.8% to CHF 2.19 bn, and the EBIT decline of 4.2% to CHF 548 mn was somewhat weaker than in the group as a whole. Specialty Chemicals recorded a decline in EBIT of 7.9% to CHF 63 mn, with sales up 4.3% to CHF 254 mn.

Ems said it expects the economy to remain subdued in 2023. Nevertheless, the company anticipates sales and EBIT for 2023 to be slightly above levels from the previous year. Management has forecast positive impetus from investments to increase capacity and energy efficiency at the headquarters in Domat and other locations, especially in China (PIE 08.06.2022).

Magdalena Martullo-Blocher (Photo: Ems Chemie) |

Considering electric vehicle production in the People’s Republic, CEO Magdalena Martullo-Blocher said China offers strong growth potential, and Ems now generates 15% of its revenues in the country. Sooner or later, China is set to replace Germany – where Ems currently generates 20% of its turnover – as the most important sales market, she noted. “The music is playing in China,” she told the Swiss newspaper Neue Zürcher Zeitung.

Related: 20% of new cars registered in China are EVs

The company has announced upcoming changes for management: On 1 March 2023, Urs Janssen, head of the Ems-Services division and Domat site manager since 2019, is to move to the executive board of the group. The successor for his current position will be Didier Grichting. Additionally, chief financial officer Oliver Flühler plans to leave the company in mid-May. His duties will be taken over on an interim basis by Peter Germann, who was the CFO until 2017.

Related: 20% of new cars registered in China are EVs

The company has announced upcoming changes for management: On 1 March 2023, Urs Janssen, head of the Ems-Services division and Domat site manager since 2019, is to move to the executive board of the group. The successor for his current position will be Didier Grichting. Additionally, chief financial officer Oliver Flühler plans to leave the company in mid-May. His duties will be taken over on an interim basis by Peter Germann, who was the CFO until 2017.

15.02.2023 Plasteurope.com [252195-0]

Published on 15.02.2023

German version of this article...

German version of this article...