YEAR IN REVIEW

Plastics industry braces for fresh surprises and more business as usual in 2012 / Price volatility and economic uncertainty / For some segments 2011 beats expectations / Fracking and plastic bag ban are key issues

As old man 2011 prepares to depart for parts unknown he may have a few words of advice for baby 2012 – the most important being “Keep your head down, kid.” Indeed, the newcomer will need nerves of steel to keep from bending as the financial and political actors go through their typical gyrations and put the rest of the real economy under pressure.

As December waned, the European plastics industry’s movers and shakers and those whose fate it is to be moved and shaken were bracing for a fresh round of surprises and more business as usual. Was the booming ending, or was this simply a temporary dip? Which branches would decamp for Asia in the medium to short term? If the Japanese earthquake and tsunami did not bring the world economy to its knees, what would a possible realignment of the euro zone, or even a collapse of the common currency mean? Would banks under pressure restrict access to credit as they did in 2008 and 2009?

As December waned, the European plastics industry’s movers and shakers and those whose fate it is to be moved and shaken were bracing for a fresh round of surprises and more business as usual. Was the booming ending, or was this simply a temporary dip? Which branches would decamp for Asia in the medium to short term? If the Japanese earthquake and tsunami did not bring the world economy to its knees, what would a possible realignment of the euro zone, or even a collapse of the common currency mean? Would banks under pressure restrict access to credit as they did in 2008 and 2009?

| |

| The most important events of 2011 at a glance ... |

Which direction will petrochemical and polymer prices take next year? Will the Middle East finally gain dominance of the market’s upstream end or will the sceptre pass to China, just as many believe the sceptre will pass over Britain’s long-suffering Prince Charles? If money is tight, will consumers continue buying new cars? Will they abandon plastic carrier bags if they have to pay for them? Will the Chinese and Arabs, once in the driver’s seat, begin making their own plastics machinery or continue to buy from Germany or Italy?

On the cusp of 2009, the last major crisis year, amid the discussion of which polymer plants would have to be mothballed because of a demand and credit crunch, the industry also speculated on whether the economic curve might take a U or a V-shape, or if there would be a “double-dip” recession. While some power players in the US plastics industry were asking the same question, the mighty German industry was more upbeat. If recession comes, it will not be as bad as 2008-2009 was the general tenor of those commenting in recent weeks.

Although economics were overshadowing all else at the end of 2011, many seasoned industry watchers were muttering under their breath, “been there, seen that.” Economic cycles bounce up and down but as lobby organisations such as PlasticsEurope succinctly point out, plastics are now a fact of life. No matter how soft the economy becomes, polymers will continue to increasingly drive automotive applications. Even if fewer tablet computers and mobile phones are sold, they will still be made of plastic.

In good and bad years alike, catastrophes come and go, economies fail and revive, companies are bought and sold, polymer and oil prices bounce up and down. New production plants are built and old ones shuttered. Innovative technologies replace former “gold standard” processes, industry leaders retire and new faces take their place. And so it was again in 2011.

One new development, of which few took much notice, was the arrival of women in the top ranks of Europe-based chemical and plastics producers. Following BASF’s annual general meeting in May, Margret Suckale became the first woman to sit on the managing board – see Plasteurope.com of 22.10.2010. In October, Karyn Ovelmen was named CFO of LyondellBasell – see Plasteurope.com of 13.10.2011. An old issue that reared its head again and growled was the ban on plastic carrier bags.

| The most important events of 2011 at a glance ... |

Polymer production: Shale gas is a game changer

Driven by crude oil’s surge, notations for petrochemicals and polymers continued to spiral sharply upward in 2011, even if the forces majeures that dominated 2010 had largely abated. But by May, with the initially strong demand receding, notations came off their peak – just as increasing economic uncertainty placed a question mark over further worldwide developments. For polymer producers, whose margins had begun to mend nicely, quo vadis was a burning question.

At the end of 2011 it was clear that the volatility had finally come home to roost in the market’s midsection. Producers were being increasingly squeezed between soaring feedstock prices and order boycotts by nervous customers speculating on lower materials prices. Here, a reverse of geographic reality became evident – producers of polyolefins and styrenic polymers in northwest Europe were on the sunny side of the plastics equator, while competitors in the south exceedingly doubted the sustainability of their earnings.

At the end of 2011 it was clear that the volatility had finally come home to roost in the market’s midsection. Producers were being increasingly squeezed between soaring feedstock prices and order boycotts by nervous customers speculating on lower materials prices. Here, a reverse of geographic reality became evident – producers of polyolefins and styrenic polymers in northwest Europe were on the sunny side of the plastics equator, while competitors in the south exceedingly doubted the sustainability of their earnings.

In October, French oil giant Total announced a reorganisation of European downstream units in the hopes of yielding more synergies (Photo: Total) |

One polymer has had an especially rough ride this year. The long-awaited shake-out in the PVC market appears to be well in progress as a slack building economy pressures all European countries except, for now, Germany. In June, Belgium’s Tessenderlo exited the business, agreeing to sell all assets to Kerling, the umbrella organisation for the activities run by Ineos ChlorVinyls – see Plasteurope.com of 15.06.2011. Its lead was followed by France’s Arkema in November, selling its entire vinyls chain to the Swiss family-owned Klesch group – see Plasteurope.com of 24.11.2011.

Like most of the country’s once-thriving petrochemical industry, Italy’s PVC sector has been beset by structural as well as economic problems. Efforts to find new owners for the Vinyls Italia assets once belonging to Ineos remained stalled for most of the year, until Industrie Generali in November officially signed on as new owner of the Ravenna site, promising to produce 140,000 t/y of PVC in 2012 – see Plasteurope.com of 09.11.2011.

Dwindling profitability of individual polymers or polymer producers is one thing – the future of European and North American plastics production is quite another. Some observers, especially industry consultants such as the UK-based Business Monitor International have warned that the US might have to close a significant amount of capacity to remain competitive with lower-cost players in the Middle East and Asia – see Plasteurope.com of 08.02.2011.

China, where North American and European polymer producers have been widening their footprint over the past decade, looks poised to benefit, becoming a second – or perhaps even a first – plastics business home for some businesses. Late last year, Bayer MaterialScience announced that it would relocate the headquarters of its polycarbonate business to Shanghai – see Plasteurope.com of 10.12.2010. BASF’s board member for plastics and Asia, Martin Brudermüller, is already based in China, where in October the first stage of a USD 1.4 bn upgrade of the its Nanjing site kicked off.

Like most of the country’s once-thriving petrochemical industry, Italy’s PVC sector has been beset by structural as well as economic problems. Efforts to find new owners for the Vinyls Italia assets once belonging to Ineos remained stalled for most of the year, until Industrie Generali in November officially signed on as new owner of the Ravenna site, promising to produce 140,000 t/y of PVC in 2012 – see Plasteurope.com of 09.11.2011.

Dwindling profitability of individual polymers or polymer producers is one thing – the future of European and North American plastics production is quite another. Some observers, especially industry consultants such as the UK-based Business Monitor International have warned that the US might have to close a significant amount of capacity to remain competitive with lower-cost players in the Middle East and Asia – see Plasteurope.com of 08.02.2011.

| The most important events of 2011 at a glance ... |

China, where North American and European polymer producers have been widening their footprint over the past decade, looks poised to benefit, becoming a second – or perhaps even a first – plastics business home for some businesses. Late last year, Bayer MaterialScience announced that it would relocate the headquarters of its polycarbonate business to Shanghai – see Plasteurope.com of 10.12.2010. BASF’s board member for plastics and Asia, Martin Brudermüller, is already based in China, where in October the first stage of a USD 1.4 bn upgrade of the its Nanjing site kicked off.

With growing doubt about the viability of plastics production in Europe and North America, China looks good to some (Photo: BASF) |

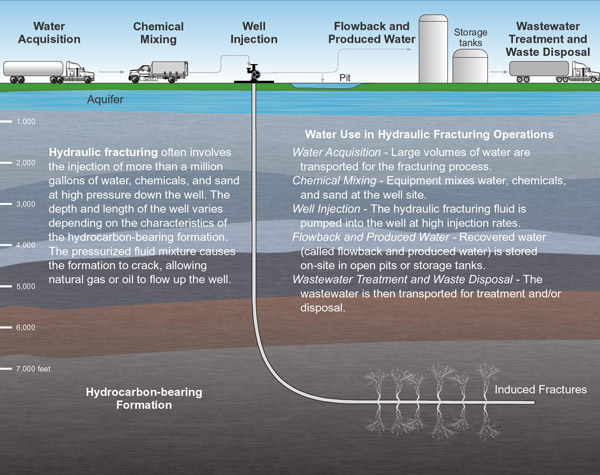

Don’t write North America off yet, plastics producers there insist – they have an ace up their sleeves. New technologies for extracting shale gas from rock formations are generating considerable excitement across the continent, especially in the northeastern US and southwestern Canada – see Plasteurope.com of 11.07.2011. Profitability of the so-called fracking technology is claimed to be well beyond that of naphtha if not quite on eye level with the Middle East’s richesse. Ambitious projects capable of turning out more than 5m t/y of ethylene are on the drawing boards – 20% more than capacities already installed.

Even if French producers will never drill under the Eiffel Tower, the otherwise eager British fear earthquakes and the ever cautious Germans dread contaminated water, the hype is spreading worldwide. Poland and China – the latter claims to have bigger reserves than the US – are enthusiastic proponents. The technology nevertheless begs ecological issues, especially as the combustible mix of gas and chemicals used to extract it is finding its way into drinking water near the extraction sites.

Even if French producers will never drill under the Eiffel Tower, the otherwise eager British fear earthquakes and the ever cautious Germans dread contaminated water, the hype is spreading worldwide. Poland and China – the latter claims to have bigger reserves than the US – are enthusiastic proponents. The technology nevertheless begs ecological issues, especially as the combustible mix of gas and chemicals used to extract it is finding its way into drinking water near the extraction sites.

|

Plastics Processing: Pricing headaches persist

In February, Germany’s plastics converters association Gesamtverband Kunststoffverarbeitende Industrie suggested that the “increasingly faster upward spiral” of polymer prices was becoming as big a problem for its companies as supply shortages – see Plasteurope.com of 10.02.2011. By the end of the year, it was clear that profitability of the sector, at least in the German-speaking countries, would return to the pre-crisis level. Industry leaders see the crisis as over, although auto suppliers continue to scrutinise new car registration statistics for any signs of flagging demand. In December, the automotive engines driving demand were still running on all cylinders.

Roland Roth: The rising cost of polymer materials is pressuring the bottom line (Photo: RKW) |

For much of the past year, packaging producers staggered under the weight of buoyant polymer prices. In an exclusive interview with Plasteurope.com, Roland Roth, CEO of RKW, Europe’s largest producer of flexible polyolefin films, spoke among other things of the problems caused by index clauses pegging polymer prices to developments upstream – see Plasteurope.com of 25.02.2011.

Mergers and acquisitions in the plastics processing sector were still en vogue in 2011. Dominating the action were a number of new players. Poland’s Boryszew gobbled up Italy’s Maflow and four German companies, including AKT, Theyson, Wedo and Ymos. India’s Ruia snatched sealants producer Draftex, the Czech-German Meteor group and France’s Sealynx – see Plasteurope.com of 23.05.2011. Insolvent German sealants manufacturer SaarGummi fell into the hands of a Chinese company, Chongqing Light Industry. One of Europe’s biggest plastics processors, OEM supplier Peguform was handed over by Austria’s Cross Industries to the Indian Samvardhana Motherson Group – see Plasteurope.com of 15.07.2011.

In the plastic packaging sector, Florida-based private equity group Sun Capital Partners was very acquisitive again in 2011. After having bought Veriplast, Albea and Betts in previous years, Sun enlarged its portfolio to include players in Finland, UK, Germany, Hungary and Belgium, including Huhtamaki Rigid Consumer Goods, Britton Flexibles, Unterland, Pannunion and Kobusch-Sengwald. The US group now owns European packaging activities with more than EUR 4 bn in annual sales resulting from 16 buyouts in five years.

Environmental concerns also impacted the packaging marketplace this year. Despite the progress in developing and producing biopolymers, questions about the sustainability of in particular non-biodegradable plastic bags lingered – reinforced by the alarming, although confusing and not always accurate, sightings of vast clusters of waste plastics clogging the oceans. Bag bans have been proposed but rarely implemented other than in a few local areas, but last January’s ban in Italy, of all places, prompted the European Union to mull legislation of its own – see Plasteurope.com of 23.08.2011.

Mergers and acquisitions in the plastics processing sector were still en vogue in 2011. Dominating the action were a number of new players. Poland’s Boryszew gobbled up Italy’s Maflow and four German companies, including AKT, Theyson, Wedo and Ymos. India’s Ruia snatched sealants producer Draftex, the Czech-German Meteor group and France’s Sealynx – see Plasteurope.com of 23.05.2011. Insolvent German sealants manufacturer SaarGummi fell into the hands of a Chinese company, Chongqing Light Industry. One of Europe’s biggest plastics processors, OEM supplier Peguform was handed over by Austria’s Cross Industries to the Indian Samvardhana Motherson Group – see Plasteurope.com of 15.07.2011.

In the plastic packaging sector, Florida-based private equity group Sun Capital Partners was very acquisitive again in 2011. After having bought Veriplast, Albea and Betts in previous years, Sun enlarged its portfolio to include players in Finland, UK, Germany, Hungary and Belgium, including Huhtamaki Rigid Consumer Goods, Britton Flexibles, Unterland, Pannunion and Kobusch-Sengwald. The US group now owns European packaging activities with more than EUR 4 bn in annual sales resulting from 16 buyouts in five years.

Environmental concerns also impacted the packaging marketplace this year. Despite the progress in developing and producing biopolymers, questions about the sustainability of in particular non-biodegradable plastic bags lingered – reinforced by the alarming, although confusing and not always accurate, sightings of vast clusters of waste plastics clogging the oceans. Bag bans have been proposed but rarely implemented other than in a few local areas, but last January’s ban in Italy, of all places, prompted the European Union to mull legislation of its own – see Plasteurope.com of 23.08.2011.

| The most important events of 2011 at a glance ... |

Plastics Machinery: Rebound exceeds all hopes

The European plastics and rubber machinery industry was on course to match the record sales achieved in 2008, the region’s federation of plastics and rubber machinery manufacturers, Euromap, predicted at its triennial general assembly in Munich / Germany in October – see Plasteurope.com of 21.10.2011. “Our industry has recovered very well from the economic and financial crisis,” said Euromap president Bernhard Merki. The core machinery business – where output had seen the greatest recession-related drop – was expected to reach almost EUR 11 bn.

Germany remains the world´s largest plastics machinery producer and exporter (Photo: Krauss-Maffei) |

The machinery sector also is making progress on the energy front. Euromap has endorsed the European Commission’s goal to cut consumption by 20% up to 2020, a target it believes is achievable – see Plasteurope.com of 03.10.2011. Most of the savings are expected to come from technology innovations combined with new drive designs, further increases in productivity and from new multistage processes.

Separately, the world’s largest plastics machinery producer and exporter, Germany, appears to be climbing toward another peak. In November, the plastics and rubber committee in the German Engineering Federation VDMA again revised its forecast for 2011 upward. Annual revenue is now expected to rise by 22% to a record of nearly EUR 6 bn. In 2012, the industry will probably have to bask in the sunlight of its earlier success, however. With new order growth slacker, committee general manager Thorsten Kühmann said a sales decline of around 7% looks likely next year – see Plasteurope.com of 08.12.2011.

Separately, the world’s largest plastics machinery producer and exporter, Germany, appears to be climbing toward another peak. In November, the plastics and rubber committee in the German Engineering Federation VDMA again revised its forecast for 2011 upward. Annual revenue is now expected to rise by 22% to a record of nearly EUR 6 bn. In 2012, the industry will probably have to bask in the sunlight of its earlier success, however. With new order growth slacker, committee general manager Thorsten Kühmann said a sales decline of around 7% looks likely next year – see Plasteurope.com of 08.12.2011.

| The most important events of 2011 at a glance ... |

19.12.2011 Plasteurope.com [221080-0]

Published on 19.12.2011