POLYCASA

Rebranding the former Quinn Plastics / Broad portfolio of transparent and translucent sheet / Margins suffer following price decline for semi-finished products

Dutch plastic sheet manufacturer Quinn Plastics (Geel) has rebranded itself as Polycasa (www.polycasa.com). The new name was unveiled by the group’s Specialty Projects director Peter Kelly at its main production site in Mainz / Germany on 10 October 2013. The company, which had suffered a lot of financial hardship over the last few years, hopes the new name and the accompanying slogan – “Your home for plastic sheet" – will help it regain its footing in the European market.

According to Wilfried Bernhard, the company’s sales manager for western Europe, the new owners of parent company Quinn Manufacturing Holding are even planning to inject money into the business in order to achieve that goal. The money, including a financial injection by majority shareholder Barclays Bank, is to go towards R&D rather than a capacity expansion, Bernhard said.

However, this focus on developing new products does not mean that Polycasa has a need to catch up to other market players. “We are in good shape,” Bernhard said, and although Kelly did not give any specific numbers, he did respond to a relevant query by saying that the company’s EBITDA had remained profitable during the crisis, adding that there had not been any losses. However, the former family-run business has been unable to fully make up for the more than 20% in losses incurred at the height of the financial crisis in 2009. In volume-terms, Kelly says, the company remains about 15% below its 2008 value.

According to Wilfried Bernhard, the company’s sales manager for western Europe, the new owners of parent company Quinn Manufacturing Holding are even planning to inject money into the business in order to achieve that goal. The money, including a financial injection by majority shareholder Barclays Bank, is to go towards R&D rather than a capacity expansion, Bernhard said.

However, this focus on developing new products does not mean that Polycasa has a need to catch up to other market players. “We are in good shape,” Bernhard said, and although Kelly did not give any specific numbers, he did respond to a relevant query by saying that the company’s EBITDA had remained profitable during the crisis, adding that there had not been any losses. However, the former family-run business has been unable to fully make up for the more than 20% in losses incurred at the height of the financial crisis in 2009. In volume-terms, Kelly says, the company remains about 15% below its 2008 value.

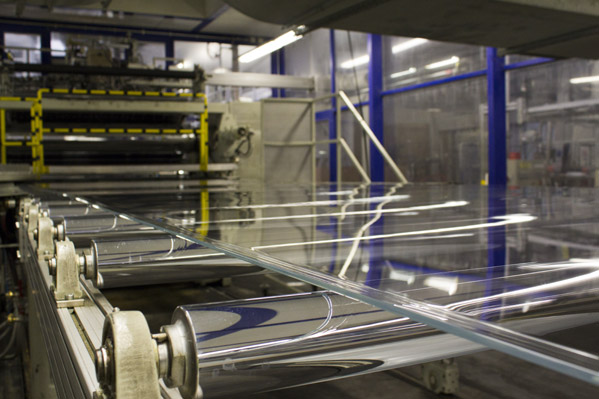

PMMA sheet extrusion at the site in Mainz (Photo: Polycasa) |

Polycasa is one of Europe’s leading manufacturers of transparent, translucent and opaque semi-finished sheet products. The company posted sales of EUR 235m last year and expects to generate about the same in 2013, even though volume sales are expected to be 6% higher. “Price hikes are difficult to push through and demand is not exactly bubbling over,” Bernhard explained the current situation. As a result, group margins contract with each feedstock price increase. In response to the question whether, in such a situation, management expects the market segment to consolidate, his answer was “not yet”. However, he did day that he expects some changes in the next 12-18 months. Kelly sums up: “There are definitely over-capacities in the sector, meaning some kind of consolidation will become necessary.”

The German-speaking countries as well as the Benelux states and Scandinavia account for about 45% of the group’s volume sales. The growth markets of central and eastern Europe generate another 20%, while the UK and Ireland stand for close to 10%. The markets in France, Italy and Spain each account for roughly 7% of Polycasa’s volume sales. As a result of lower construction activity, sales to the latter markets and the UK especially have dropped significantly.

In terms of material, the company’s main output is PMMA sheet, accounting for about 60% of the group’s roughly 90,000 t/y in nameplate capacity. In 2012, the actual amount of material produced and sold came closer to 70,000 t. Polycasa expects to slightly top that figure this year. The company’s portfolio also comprises polycarbonate, PET-G and PS sheet as well as sheet made of styrene copolymers like ABS and SAN. It is this diversity that probably makes Polycasa Europe’s leading producer of transparent sheet; while most competitors – such as Evonik, Bayer MaterialScience, Sabic and others – are able to produce higher volumes in each separate segment, none has such a broad portfolio.

Polycasa operates five plants across Europe. The one in Mainz, with nameplate capacity for 30,000 t/y, mostly turns out PMMA sheet while its other German plant, in Nischwitz, can turn out 18,000 t/y of mostly PC and PET sheet. The facility in Barcelona / Spain produces about 7,300 t/y of cast PMMA sheet, while the 11,000 t/y plant in Zilina / Slovakia is specialised on PMMA sheet. Polycasa also operates a 23,000 t/y plant in Pribram / Czech Republic, which turns out mostly styrene-based products.

After its own MMA plant in Leuna / Germany was shuttered this spring, the company now sources the necessary MMA and all other feedstock externally, and then processes the material to granules and sheet. Quinn sank EUR 190m in the Leuna plant, which never even started up – for previous coverage, see Plasteurope.com of 21.09.2011. Polycasa sells about 4,000 t of the PMMA resin it produces in Mainz and Zilina on the open market, including as an injection moulding grade used in the manufacture of vehicle rear lights.

15.10.2013 Plasteurope.com [226555-0]

Published on 15.10.2013

German version of this article...

German version of this article...