HOT RUNNER SYSTEMS

Sales in 2006 will pass the billion euro mark / Growth in China, India and Latin America / Finish-to-order allows production in less than two weeks

In the wake of the rising global consumption of plastics, increasing production volumes and the influx of new processors, the international market for hot runner systems has been experiencing a new lease of life. In 2005, the market saw 6.2% growth against 2004 in terms of value, with global sales at almost EUR 1 bn. Market researchers at InterConnection Consulting Group (IC, Vienna / Austria; www.interconnectionconsulting.com) expect a continuation of this positive trend. The report "IC Market Tracking Hot Runners 2006" forecasts a volume of more than EUR 1.1 bn by 2008.

| |

Production time cut from eight to less than two weeks

In western Europe, about 70% of injection moulds are estimated to have hot-runner systems. In 2002, only 30% of moulds were thus equipped. In the US, the share of equipped moulds is slightly less, while only between 30% and 40% of all moulds in eastern Europe and Asia are fitted with a hot runner system. The use of hot runners is particularly widespread in high-wage countries, where secondary finishing of sprues would lead to substantial extra costs, and the deployment of hot runner systems rises proportionately with the size and number of the parts to be produced. One reason for this is the price. Hot runner systems – part of the "hot half" of the mould – can cost between EUR 2,000 for simple and EUR 200,000 or more for complex structures.

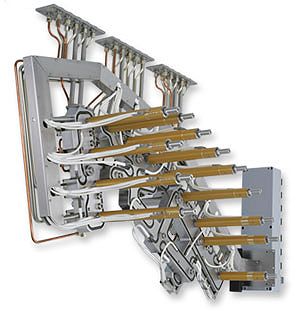

Hot-runner system (Photo: Incoe) |

In addition to mould requirements, production time requirements also have undergone a major change. While only two years ago, a production period of six to eight weeks was considered acceptable, the market leaders are now aiming for delivery within less than two weeks, despite the fact that hot runners, while modular in design, are very customer-specific products.

Future of the industry lies in the east

According to IC, the industry is currently in a restructuring phase, due to the opening of markets in eastern Europe and Asia and double-digit growth rates in emerging markets. Despite an ongoing increase in the consumption of plastics, both the European and the US markets have reached a state of maturity that leaves no room for significant growth. In 2005, the US sales value of hot runner systems rose by 2%. Europe saw a 2.6% rise, with the lion´s share attributed to sales in eastern Europe, and western Europe showing a rise of only 1.4%. In western Europe, the 40.3% share of the global market achieved in 2002 sank to 36.1% in 2005. Over the same period, the US share fell from 35.6% to 32.5%. Southeast Asia is expected to outperform the US; its share is expected to rise to 29.7% by 2008.

At present, eastern Europe and other emerging markets in Asia and Latin America are the growth engines for the hot runner industry – as in almost all branches of industry. In 2005, sales in eastern Europe were up 16.6%, southeast Asia (dominated by China) saw an 18.5% sales rise and countries outside of Europe, the US and southeast Asia reported a 12.2% increase. Despite the fact that eastern Europe and emerging markets represent only about a third of the hot runners market, they account for two-thirds of its growth.

Future of the industry lies in the east

According to IC, the industry is currently in a restructuring phase, due to the opening of markets in eastern Europe and Asia and double-digit growth rates in emerging markets. Despite an ongoing increase in the consumption of plastics, both the European and the US markets have reached a state of maturity that leaves no room for significant growth. In 2005, the US sales value of hot runner systems rose by 2%. Europe saw a 2.6% rise, with the lion´s share attributed to sales in eastern Europe, and western Europe showing a rise of only 1.4%. In western Europe, the 40.3% share of the global market achieved in 2002 sank to 36.1% in 2005. Over the same period, the US share fell from 35.6% to 32.5%. Southeast Asia is expected to outperform the US; its share is expected to rise to 29.7% by 2008.

At present, eastern Europe and other emerging markets in Asia and Latin America are the growth engines for the hot runner industry – as in almost all branches of industry. In 2005, sales in eastern Europe were up 16.6%, southeast Asia (dominated by China) saw an 18.5% sales rise and countries outside of Europe, the US and southeast Asia reported a 12.2% increase. Despite the fact that eastern Europe and emerging markets represent only about a third of the hot runners market, they account for two-thirds of its growth.

| |

At present, China is clearly the most exciting region for the hot runner industry. Most major manufacturers of hot runner systems already have installed production and assembly facilities in the country, while smaller companies are trying to move into market by means of joint ventures with local partners. In doing business with the Chinese, especially transferring technology, most players still exert extreme caution, due to a fear of product piracy.

On the other hand, many manufacturers have no option but to move into the Chinese market if they want to survive. The strained European market, cutthroat competition, the rising price of raw materials, low selling prices and tight profit margins are all detrimental to business. Some companies have been trying to leverage innovation and specialisation to keep abreast of the competition. Promising segments are the packaging industry and medical engineering, which last year saw double-digit growth rates.

According to Husky Injection Molding Systems (Bolton, Ontario / Canada; www.husky.ca), the industry´s second largest player, 43% of its hot runner systems go into packaging. As a reaction to this development, the company launched its "Ultra Packaging" nozzle, a special solution tailored to packaging applications.

The east-west divide is expected to widen over the coming years. Experts predict that economic growth and elevated lifestyles will boost consumption rates in booming regions such as eastern Europe, China and India. There is an enormous potential, as the consumption of plastics in these countries is still at a very low level. InterConnection Consulting therefore predicts robust growth and no saturation of the markets in the near future. For many hot runner manufacturers, being present in these markets is of vital importance.

Unchallenged market leader for many years, Canada´s Mold-Masters Ltd (Georgetown, Ontario / Canada; www.moldmasters.com) also is banking on the Chinese market. This specialised company invested an additional USD 20m to increase the number of machines at its Kunshan/China plant, which came on stream in March 2006. The number of employees is to be doubled from the currently150 to 300 by the end of 2007. Every year, the company´s sales in China increase by 100%, president Jonathon Fischer recently explained at the US "National Plastics Exhibition" (NPE). About 30% are attributed to orders from local processors. Mold-Masters employs 1,500 people and reports a market share of between 25% and 30%.

In 2005, Husky opened a second facility at Shenzhen to support the company´s Shanghai site, which was established in 2004 and will cater to customers in southern China. Fast delivery, which is expected in this region, is achieved by means of a "Finish-to-Order" (FTO) system. This modular approach allows customers to assemble their product by following basic instructions as in a "do-it-yourself" kit. Owned by US private equity group Advent International (Boston, Massachusetts / USA; www.adventinternational.com) since August 2005, the US specialist Synventive Molding Solutions (s´-Gravendeel / The Netherlands; www.synventive.com) officially opened its plant at Suzhou, near Shanghai, at the end of October 2005 – see Plasteurope.com Web of 25.11.2005.

Number four in IC´s ranking, Korea´s Yudo (Hwasun City; www.yudo.co.kr) is the only Asian player among the industry´s five largest. The company made its first moves into the European market in mid-2006, when it took over MR-Tech (Cesate / Italy; www.mr-tech.it), a specialist for hot runner systems for packaging applications. According to CEO Francis Yu, his company plans to consolidate its position in the European market.

The US company Incoe (Troy, Michigan / USA; www.incoe.de) is number five on the list. To celebrate its 50th anniversary, Incoe introduced the "DF Gold" Series hot runner system with an improved nozzle configuration, two separate heating circuits and new "color seal" technology. In June 2006, the company established a partnership with Beaumont Technologies (Erie, Pennsylvania / USA; www.beaumontinc.com) to focus on the advancement of the "MeltFlipper" melt management technology.

02.11.2006 Plasteurope.com [206418]

Published on 02.11.2006

German version of this article...

German version of this article...